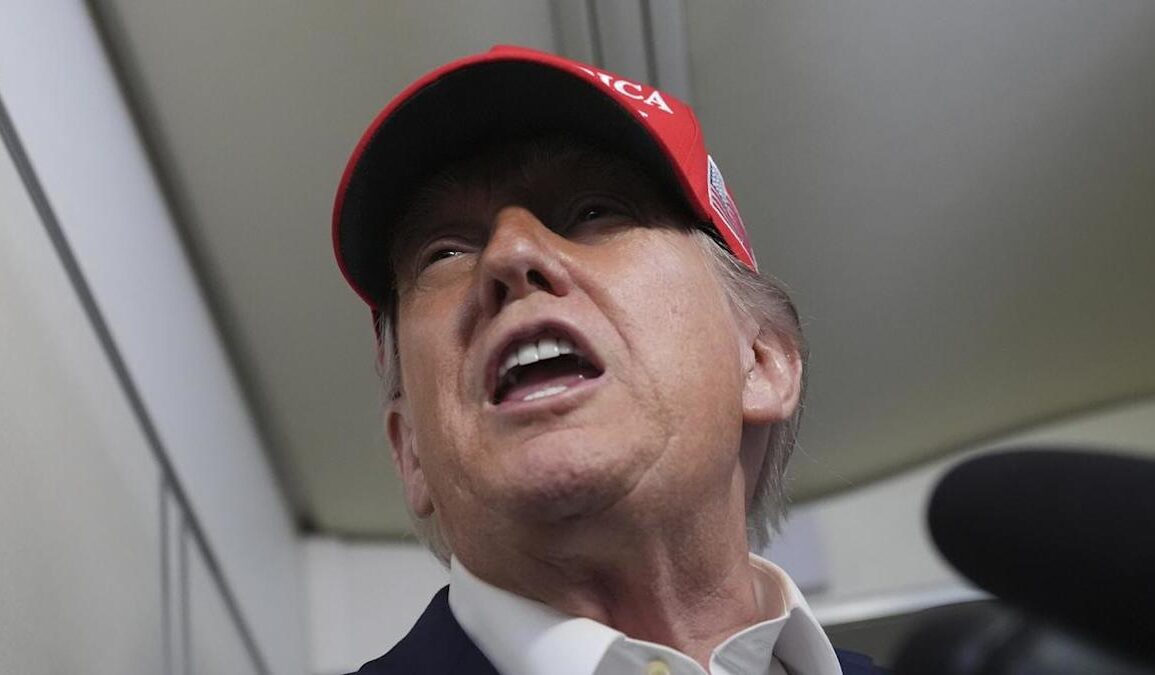

On Monday, July 7, 2025, President Donald Trump will send letters to approximately twelve countries, outlining new tariff rates on their goods exported to the United States. This bold move, announced aboard Air Force One on Friday, July 4, signals a dramatic escalation in the ongoing global trade war. “I signed some letters and they’ll go out on Monday, probably twelve,” Trump told reporters, adding that the letters will specify “different amounts of money, different amounts of tariffs.” With potential rates as high as 70% set to take effect on August 1, this development has already rattled financial markets, with European stocks and U.S. stock futures declining on Friday. For businesses and consumers, the move threatens to disrupt a period of relative economic stability, reintroducing uncertainty into global trade.

Why Tariffs Matter

Tariffs, taxes imposed on imported goods, directly affect the cost of products ranging from electronics to food. For businesses, higher tariffs mean increased costs for raw materials and components, which can lead to higher prices for consumers or reduced profits. The announcement comes after months of warnings from Trump, who has long championed tariffs as a tool to protect American industries. However, this abrupt shift could unsettle industries that have adapted to a post-tariff environment. As the Axios report notes, “For businesses craving certainty, who’ve had a period of relative calm of late, the move could once again upset that balance.” Financial markets, which had largely moved on from the tariff-heavy policies of Trump’s earlier tenure, now face renewed risks, as evidenced by Friday’s market declines.

The decision also carries significant geopolitical weight. By targeting a dozen countries—whose identities Trump has not yet disclosed—the U.S. risks straining relationships with key trading partners. The looming tariffs could prompt retaliatory measures, further complicating global trade dynamics. Countries like South Korea and Thailand are reportedly scrambling to negotiate last-minute deals to avoid steep tariffs, highlighting the high stakes involved.

A Strategic Shift in Trade Policy

Trump’s tariff strategy is not entirely new but reflects a shift in approach. In April, he announced a 10% base tariff rate on most countries, with some facing rates as high as 50%. However, these were paused for 90 days to allow negotiations, a period set to expire on July 9. Initially, Trump and his aides promised “90 trade days in 90 days,” aiming for swift deals with multiple nations. Yet, only three agreements—with the UK, China, and Vietnam—have materialized in the first 85 days. The UK secured a 10% rate with preferential treatment for sectors like autos and aircraft engines, while Vietnam’s tariffs were reduced from a threatened 46% to 20%. Many U.S. products now enter Vietnam duty-free, showing that negotiations can yield results.

However, talks with other major partners, such as Japan, the European Union, and India, have stalled. Frustrated by these setbacks, Trump has soured on complex negotiations. “The letters are better … much easier to send a letter,” he remarked on Friday, indicating a preference for unilateral action over prolonged talks. This “take it or leave it” approach allows the U.S. to set tariff rates without waiting for reciprocal agreements, though it risks escalating tensions with trading partners.

The letters are a tactical move, designed to pressure countries into concessions. As Axios reports, “The administration has used a similar tactic before — taking an aggressive posture on coming tariffs, but with a deadline just far enough out that trading partners could still bring last-minute offers the president would be willing to accept.” With rates set to take effect on August 1, countries have less than a month to respond, potentially leading to a flurry of diplomatic activity.

Flexible Deadlines and Strategic Goals

While the tariff pause officially ends on July 9, some countries face separate deadlines. For instance, China and Canada have until later in July or August to finalize agreements. Treasury Secretary Scott Bessent has suggested that these deadlines are “fungible,” with the broader goal of concluding trade deals by Labor Day. This flexibility indicates that the administration is open to negotiations but prefers the simplicity of imposing tariffs via letters.

The tariff rates themselves remain a point of intrigue. Trump hinted on Thursday that some could reach 70%, a significant jump from the 10% baseline or even the 20% rate secured by Vietnam. The Vietnam deal, for example, doubled the global baseline but was less than half the originally threatened 46%, suggesting that final rates may vary widely based on negotiations or strategic priorities. The lack of clarity about which countries will receive letters adds to the uncertainty, as Trump declined to name them, stating only that the list would be revealed on Monday.

Global Reactions and Market Impacts

The announcement has already prompted reactions from trading partners. South Korea and Thailand are reportedly rushing to secure deals, while EU diplomats admitted on Friday that they have failed to achieve a breakthrough in talks with the Trump administration. Some countries may seek to extend the status quo to avoid tariff hikes, but without progress, they face significant economic consequences.

Financial markets are also feeling the strain. European stocks fell on Friday, reflecting concerns about the impact of tariffs on global trade. U.S. stock futures followed suit, signaling investor unease about potential disruptions to supply chains and corporate earnings. The Reuters report underscores this, noting that the trade war “has upended financial markets and set off a scramble among policymakers to guard their economies.” For industries reliant on global supply chains, such as automotive or technology, the tariffs could lead to higher costs and reduced competitiveness.

Historical Context and Future Outlook

Trump’s tariff strategy echoes his earlier presidency, where he imposed sweeping tariffs on steel, aluminum, and Chinese goods. Those policies sparked retaliatory tariffs from trading partners, leading to higher prices for American consumers and farmers. The current approach, however, is more targeted, focusing on a select group of countries while leaving room for last-minute deals. The limited success of earlier negotiations—only three deals in 85 days—suggests that achieving comprehensive trade agreements is challenging, especially on an accelerated timeline. As Reuters notes, “Most past trade agreements have taken years of negotiations to complete.”

Looking ahead, the next few weeks will be critical. Will countries like South Korea and Thailand secure favorable deals, or will they face steep tariffs? Can the EU and Japan find common ground with the U.S., or will they resort to retaliatory measures? The answers will shape not only bilateral trade relationships but also the broader global economy. For now, businesses and investors are bracing for impact, navigating a landscape where certainty is scarce.

As Trump prepares to send his tariff letters, the world watches closely. The move could either force concessions from trading partners or ignite a new phase of economic conflict. With the August 1 deadline looming, the stakes are high, and the outcome remains uncertain.